Compensation and Pay Mix (Part 1)

Vencon Research Insights | By: Andy Klose | December, 2019 | Compensation, Pay Mix

In the following article, we would like to highlight an aspect of remuneration strategy that is often insufficiently taken into account: The ratio of fixed to variable compensation (also called “pay mix”).

When many of the other significant compensation elements of competing firms are considered to be largely similar, the pay mix can be the defining differentiator, especially from an employee perspective.

One of the key concerns companies have with regards to their employees is compensation. For professional services firms in particular, employee compensation is crucial to successful recruitment, i.e. hiring the right employees, motivating them to perform at their best, and retaining employees.

We believe that the importance of offering a competitive compensation package is a given. In this first in a series of articles we want to provide insights into why the pay mix (i.e. the ratio of fixed to variable compensation), which is an aspect of compensation package design often underestimated or even ignored, can be as relevant as or even more relevant than the absolute amount of pay (e.g. base salary or total cash compensation).

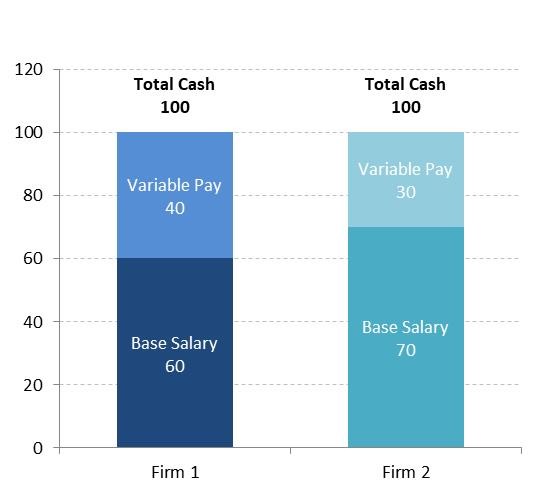

We will use the following example to illustrate this: An applicant for a consultant position receives offers for entry level positions from two comparable companies with similar status, market and growth prospects. The two firms also offer comparable future prospects and development opportunities to the employee. For simplicity, the offers available to the applicant essentially differ only with regards to the pay mix of the package offered (Exhibit 1):

We believe that most applicants will choose Firm 2’s offer. From an economic point of view this offer provides the same total cash compensation but with a higher fixed base salary. In other words, the upside potential is the same (at 100) but Firm 2’s offer guarantees greater financial safety (70 vs 60) while also providing significantly more intra-year money (+17%).

Assuming that the compensation offers are transparent to all applicants, the result of this example would likely be that Firm 2 is able to hire all top candidates. Only when all Firm 2 vacancies are filled, would the remaining candidates be forced to take the offer from Firm 1. Thus, Firm 1 would lose the competition for talent by only being able to hire the applicants not needed by Firm 2.

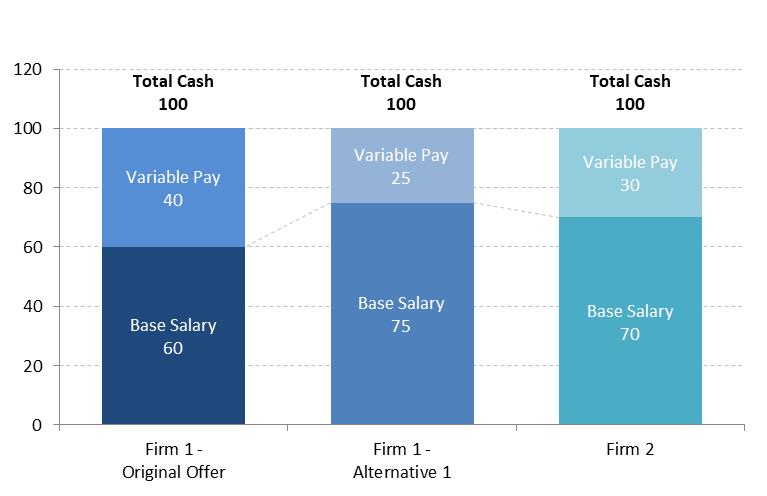

How could Firm 1 adapt their compensation model in order to be more attractive to potential employees and be in a position to compete with or beat Firm 2 in the talent acquisition game? Two alternative options stand out. Firm 1 could decide to change their pay mix and/or increase the total cash compensation of their offering.

Alternative 1 – Changing the pay mix: Increasing fixed base salary at the expense of variable pay will provide potential hires a safer offer (Exhibit 2) without the need to change total cash compensation. For the employee, Alternative 1 is more attractive than Firm 2’s offer. It is important to keep in mind, however, that this alternative also changes the financials for Firm 1: The firm now has higher fixed costs due to the higher base salary.

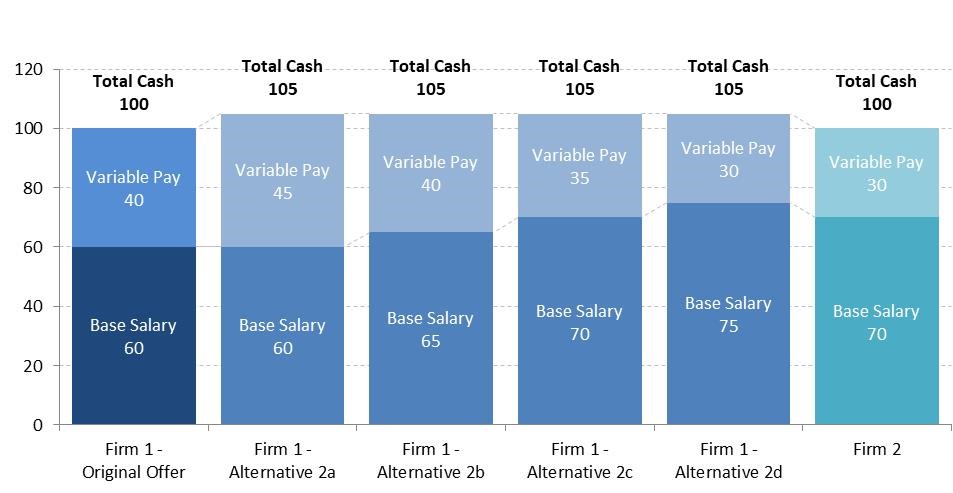

Alternative 2 – Increasing total cash compensation: The results of an increase in total cash compensation by increasing base salary and/or variable pay are shown in Alternatives 2a to 2d, where the total is increased to the same amount (105), but with different pay mixes (Exhibit 3):

From the perspective of an employee, Alternatives 2a to 2d are all better than the original offer from Firm 1. However, when examining the pay mix, Alternative 2a is the riskiest while Alternative 2d is the safest.

When comparing Alternatives 2a to 2d to Firm 2’s offer, all offer higher total cash compensation. But the situation is more differentiated when looking at pay mix: Alternatives 2a and 2b offer higher variable pay, but lower base salary than Firm 2. In case of under- or non-performance, base salary is the “safe harbour”. Some personalities will not be inclined to go for the higher total cash compensation while having the risk of ending up with (only) a lower base salary.

On the other hand, Alternatives 2c and 2d offer not only a higher target total compensation than Firm 2’s offer but also a higher or the same variable pay in conjunction with the same or higher base salary. The pay mix is considered safer. In essence, this is a win-win situation for an employee: The same or less risk, but more upside potential.

In practice we often see that certain personalities are not attracted by the marginally higher total cash compensation packages that come with a riskier pay mix (i.e. higher percentage of variable pay). In addition, in some countries and for some firms, the variable pay target may not even be considered as realistic or achievable while the only number that counts, especially with regards to recruiting employees, is base salary (i.e. the “bird in the hand” theory).

In summary, when competing firms are considered to be largely similar, the pay mix can become the key differentiator when comparing compensation, especially from the employee’s perspective. Thus, when reviewing remuneration, firms should not focus on a single component of compensation (e.g. base salary or variable pay) as these alone will not be the defining factors. Firms should instead focus on the pay mix, i.e. the ratio of fixed to variable compensation, as this strongly influences a candidate’s choice. Furthermore, under certain circumstances, a lower level of total cash compensation can even be the better deal for some employees.

We are at your disposal for further questions and suggestions regarding how you optimally design the pay mix (and/or remuneration systems) for your company.

Andy Klose is an Associate Partner at Vencon Research International and heads the firm’s consulting unit.

Vencon Research International is a leading provider of compensation benchmarking and research as well as of compensation and performance-related consulting services for professional service firms, especially for audit and tax, management consulting, and IT services firms. Vencon Research International provides services to a full range of clients in more than 75 countries worldwide and is proud to name more than 85% of the world’s major consulting and/or professional services firm its clients.